How to Track Your Spending With Google Sheets

The tricky part about budgeting isn’t starting one; it’s sticking to it. Tracking your spending can be tedious. That’s why many people don’t budget. Finding a tracking method that works for you is essential to making your budget stick. In this guide, we’ll discuss how to track your spending with Google Sheets.

Manual expense tracking not your thing? Try the BudgetSheet extension for Google Sheets! This nifty tool will automatically set up your budget and track your spending. Sticking to your budget will be that much easier!

How to Track Your Spending with Google Sheets

1. Create a budget

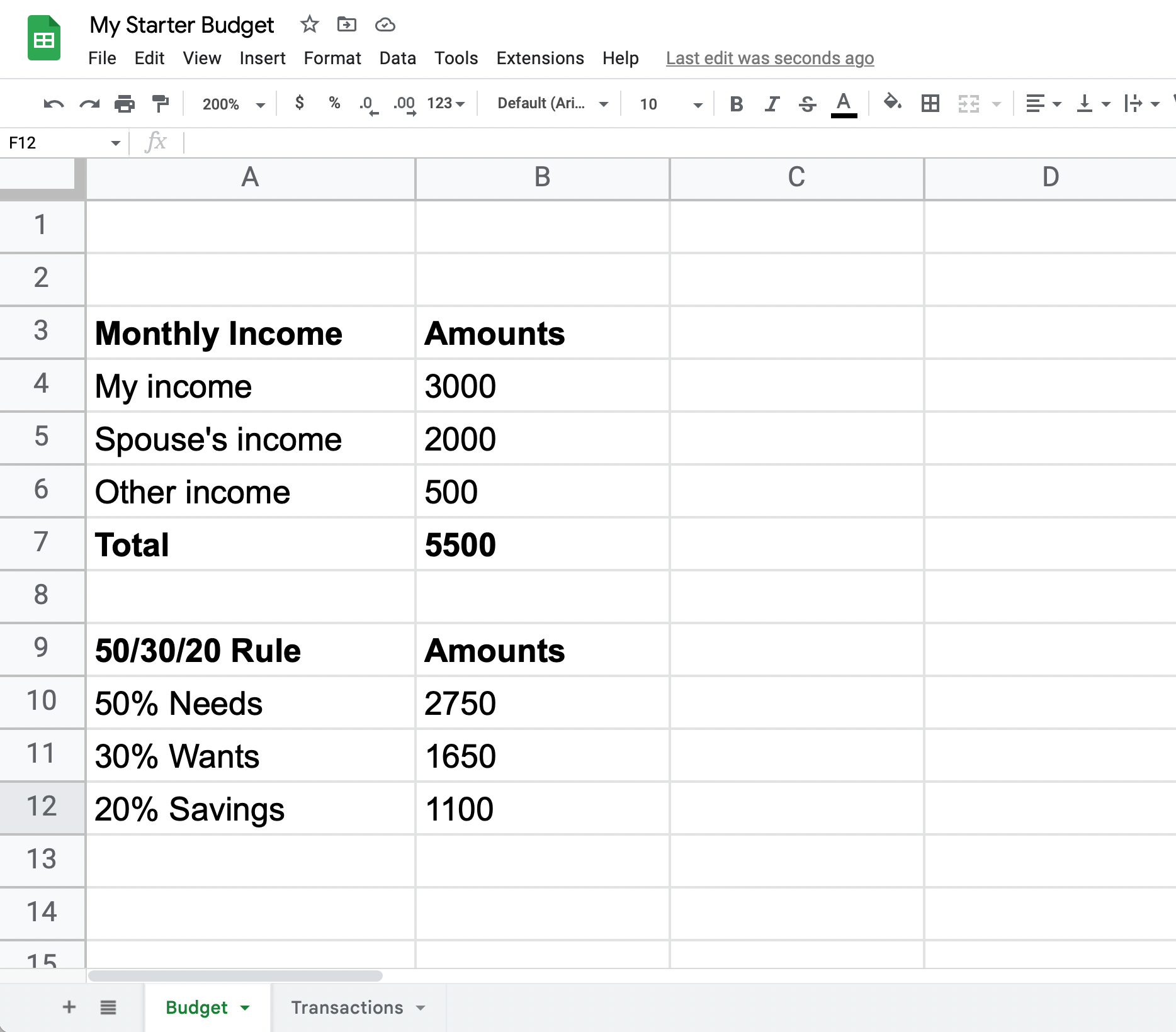

The first step to tracking your expenses is to create a budget. If you need help, check out our previous article: How to Make A Budget with Google Sheets. Creating a budget sets you up for financial success. Google Sheets makes it easy to personalize your budget. Start by listing all your income and expenses. Then subtract to see what’s leftover. Just by listing your income and expenses, you get a comprehensive view of your finances! The next step will help you find areas to improve.

2. Automate your expense tracking

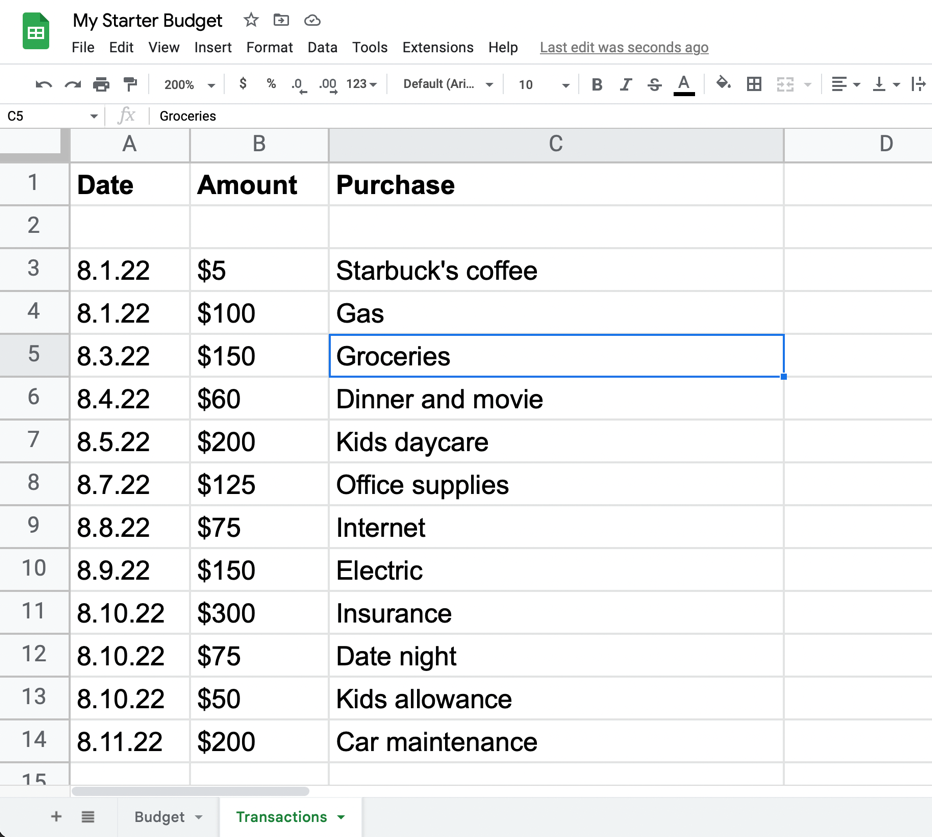

Tracking your expenses can be tedious! We recommend automatic vs. manual tracking. The BudgetSheet extension for Google Sheets is an excellent tool for this. It pulls your daily expenses automatically into your Google Sheet budget. If you prefer manual tracking, you’ll need to keep a list of every purchase you make. See an example manual transaction list below.

3. Use the 50/30/20 rule

The 50/30/20 rule is a simple way to measure your budget’s success. The rule recommends allowing 50 percent of your income for needs, 30 percent for wants, and 20 percent for savings. Your budget may not fit the rule initially, and that’s okay! The 50/30/20 rule is just a guideline. The main goal is to spend less than you make. Try adding a new column in Google Sheets to help monitor your progress.

4. Review your budget weekly

A weekly budget review helps you build the habit of expense tracking. Set a date in your calendar to review your Google Sheet. You’re looking for areas to improve. Did you spend too much on food? Did you forget to track that business purchase? Log them into your transactions list to enhance your budget’s accuracy. As time goes on, your areas to improve will be more nuanced. You may not need to review as frequently. This means your budget is working!

5. Adjust your budget monthly

Maybe you got a new business client or bought a new house. Be sure to update your budget! For example, if you added a new business client, your “other income” category may go from $500 to $750. Adjusting your budget helps you track your available margin. An income increase means changing the amounts for your other categories. In this case, maybe that extra $250 goes to a new “marketing” category for your business!

Conclusion

Budgeting and tracking your expenses can be taxing. (Pun intended). Find what works for you and stick with it. Like many aspects of life, budgeting gets better with time. Don’t give up!

Let BudgetSheet automate your expense tracking in Google Sheets

Stop doing all this by hand - it's a lot of work! Automate your expense tracking with the BudgetSheet extension for Google Sheets! BudgetSheet uses Plaid to automatically add and categorize your expenses in Google Sheets. Your financial information is safe and secure because it all stays in your own Google Sheet. Try BudgetSheet free for 45 days!

--

This article was contributed by Zachary Peterson, Financial Educator and Tech Enthusiast